Opaxe Index

How are the Opaxe Indexes calculated?

Nick

Last Update 2 years ago

What is the Opaxe Index

The Opaxe Index is calculated by converting a drilling result for the most common commodity, or mix of commodities, into a Gold Equivalence value and multiplying the figure by the length of the intercept, ie the Opaxe Index is AuEq x m.

Opaxe calculates two indexes – the Original Opaxe Index and the Current Opaxe Index. The commodities that are converted for comparison purposes are: Iridium, Platinum, Palladium, Rhodium, Ruthenium, Silver, Aluminium, Copper, Iron, Lead, Nickel, Tin, Tungsten, Zinc, Cobalt, Molybdenum, Uranium and Vanadium.

The Original Opaxe Index is calculated using commodity prices from the date of the original company announcement i.e. drilling results released on 3 December 2021 will be converted into an Opaxe Index using the latest commodity prices as at 3 December 21.

The Current Opaxe Index is calculated using the latest commodity prices, i.e. drilling results from 30 June 2020 will be converted into an Opaxe Index using the latest commodity prices from the date of the search that involves the drilling results.

• Essential Plan members are able to view and export the Original Opaxe Index

• Premium and Ultimate members are able to view and export both the Original and Current Opaxe Indexes.

How do we calculate the Opaxe Index

We take the best intercept from one hole as reported on the mining company announcement and calculated the Opaxe Index from this result.

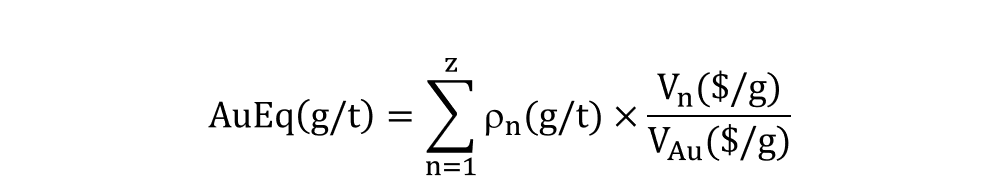

The formula used to convert drill intercept grades to gold equivalence is as follows:

Where AuEq (g/t) is the gold-equivalent grade, z is the number of listed components (e.g. Au, Ag, Pb, Cu, Zn, Sn, Co etc), Pn and 𝑉𝑛 are the mass concentration and market value of the nth component in the list, respectively, and 𝑉𝐴𝑢 is the market value of gold. The opaxe Indexes are then calculated via AuEq x length (m).

The AuEq has been calculated using current commodity prices that may be found at the following sites: https://www.dailymetalprice.com/ and https://www.vanadiumprice.com/

Why is Gold used

Gold has been chosen as the metal equivalent for all conversions as it is the most widely used and best-understood benchmark to determine or appreciate the grade tenor of a drilling intercept. Opaxe has not investigated or considered metallurgical recoveries when converting drilling intercept grades to AuEq values. It is uncertain that all the elements included in the metal equivalents calculations have a reasonable potential to be recovered and sold. For many projects at the Exploration Results stage, metallurgical recovery information may not be available or able to be estimated with reasonable confidence. Users of my.opaxe.com and readers of the Opaxe Reviews need to use reasonable caution to avoid being misled in these instances.

Top five and top ten comparisons

The weekly top five and year-to-date top ten tables show the best intercepts, by Opaxe Index, in the relevant period. Separate tables for companies listed on the ASX, TSX/TSX-V, and other exchanges are produced. Opaxe considers all drilling results in the week that they are originally released for inclusion in that week’s top five tables. Updated or re-released drilling results are not considered for comparison with other drilling results in the relevant week. However updated or re-released results will be included in the comparison for the year-to-date top ten Opaxe Index tables.

Related Topics

See the article 'Disclaimer and Compliance Warning'